Case Study 1 – Financial Services – John Dunion

Background

John Dunion reported that he had met John Seddon 10 years ago whilst working for a large financial services organisation, and had taken a dislike to him as John D had done alright in a Command and Control structure, working his way up to a senior manager and here was John Seddon telling him he was doing things wrong. This made him quite resentful of Vanguards approach. However once he got into the work and learnt to see, it completely changed his mind.

John elaborated more. The bank he was working for was very target driven, and as a manager of a large department he was judged on results against targets. One of the targets he had been set was for all new customers opening current accounts, 50% of them should also open a savings account. Try as he might John could never get above 30% and he was starting to come under pressure from upper management. He had tried training his staff in upselling, working with marketing on new and inventive ways of coaxing new customers to open savings accounts etc but could not break through that 30%

One day whilst at home John had a lightbulb moment, the next day he brought all of his staff together (around 80 people) and told them his brainwave.

Whenever we take a call asking for a new current account, inform the customer that they get a free savings account with it!

Guess what happened? not only did he break the 50% target but he made 100% !!! And as a result John was promoted to head up a call centre for achieving such fantastic results!

Vanguard arrived and working with an internal set of Systems Thinkers began to map out processes from customer request e.g. opening an account, to the customer leaving the bank e.g. closing an account. John was part of this internal intervention team and got into the work. He visited staff that worked on closing accounts and was amazed at the piles and piles of work they had in their queues, why were so many people closing accounts? He went and spoke to a member of staff to ask them. They reported that many customers, although having savings accounts, weren’t using them. The bank had written to them and eventually called them to remind them that they had to deposit some money into the savings accounts they had requested. What they were finding when talking to the customers, was that they hadn’t wanted a savings account, but had been given it free when opening a current account! It was at that moment that realisation dawned for John, and it was then that he truly got Systems Thinking. What had proved to be a great idea in one area of the business was causing massive waste in another.

Soon after John left (not pushed!) and joined Vanguard.

ISA Transfer Case Study

One of his first interventions was with another large high street bank. They wanted to reduce the time it was taking to transfer ISAs between banks. It is a UK government legislation that all ISA transfers must be completed bank to bank. The government had recently introduced a target of 30 days but this particular bank were achieving an average of 71 days. John arrived at the organisation and spent some time with the leaders orienting them on Systems Thinking. One of the first things he always does is show senior leaders the traditional vs Systems Thinking model (below) and ask them where they felt their organisation was, either on the right or on the left. For this organisation the orientation resulted in a normative response and John was engaged to start working to improve their ISA transfer process.

Together with one of the bank’s senior leaders John metaphorically attached a post-it with a new customer on their chest and started to follow the work from customer request to final transfer.

The Madness

The customer demand

Studying demand they found that most demand for ISA transfers came through the branch. 10% came through on-line, 30% through the phone and 60% from the branch. Interestingly most complaints (Failure Demand) came through the phone. An example of Value Demand was “I want to transfer an ISA”. An example of Failure Demands was “Where are my funds!??!?!”.

John sat with a girl who processed on-line applications. She would retype on-line applications, as they were not deemed as secure, and send these together with a letter to the customer to fill in, sign, and take into the branch!

The branch would take all requests and send it to their centre in Leeds (if you were requesting via a phone bank they would instruct the customer to sent the request forms to Leeds themselves). Regardless of source the branch would have to fill in 3 forms and send these to Leeds.

Leeds Centre

They visited the Leeds centre and found a series of expensive scanning systems, manned by a team of 70 people, scanning documents day in, day out. Following the work they found that mail comes in to the Leeds centre around 4AM where it entered high level sorting, then it was batched and sorted again. Then it was fine sorted, batched again, queued and finally scanned.

The company had purchased expensive scanning equipment that took the documents and scanned both sides at once, not only did it do that but the machine also projected both sides of the document on a screen for an operator to review. There were many operators sitting at these machines watching scanned documents fly by on their screens checking for errors. John described the operators as almost watching an electronic version of tennis, with their heads glancing left and right in rapid succession. These operators took 1 hour shifts (presumably to save neck ache). As the documents flew by at such a fast rate they had to question how many errors had been found in the department’s history? you guessed it, none!

Newcastle Centre

The scanned document and image was then sent to their Newcastle centre. They then indexed it (allocating a number against each document and it’s image). Studying Failure demand they found 3% of these had errors that had to be sent back to Leeds for rescanning (after being sorted, batched, sorted, fine sorted, batched and queued again).

West Kent Centre

The Newcastle centre then queued the work and once it got to the top of the queue was sent to West Kent (where the value work happens). West Kent at this stage would find missing information on the form, or they couldn’t read it, or it had the wrong information, and they would have to send the form back to the customer to rectify. Studying this Failure demand they found that 40% of the forms had to be sent back to the customer. After rectification the whole process would start again with the branch sending to Leeds etc.

For those forms that contained the right information West Kent would send the request form and another form to the donor bank (the bank that had the customers funds that would eventually be transferred into the requesting bank), this would usually take between 7 and 14 days to be sent to the donor bank. 100% of the time, within 14 days of sending the forms, the requesting bank heard nothing back from the donor bank, so they began to chase. How did they chase? you guessed it by sending a letter, in fact the same letter again.

After 10 days if they still had not heard from the donor bank the manager would chase them by phone. Once again this was happening 100% of the time. When watching the work John found there were so many requests to chase that the managers had delegated this to their staff, who were pretending to be their manager when calling the donor bank. What was the question they asked when the eventually got through to someone at the donor bank? “Did you get the form?” and what was the answer every time? “YES and its in the queue”. This final step of chasing by phone took up to 7 days.

Studying capability and capacity John found that their were spikes in the work load in March and April, these corresponded with the time of the new financial year and when ISAs are most active. In say October the number of requests was around 100 for that month, in April there were 60,000, that’s 60,000 with an average end to end time of 71 days.

Donor Bank Responds

Somewhere between 10 and 40 days later the requesting bank received a cheque from the donor bank. Is this the end? no! The cheque was sent back to the Leeds centre with an authority letter, who sort, batch, sort, fine sort, batch and queue as it enters into the Leeds cheque processing department. There was a team whose job it was to remove the staple from the cheque (as it had been stapled to the authority letter) and send the cheque to a colleague who enters the date received, amount etc. They found one employee who would then physically walk the length of the office with the cheque in hand, photocopy the cheque, take the photocopy and hole punch it and file it. The cheque was then sent to another department to be processed. When John asked the employee who does the photocopying the reason for this step, the answer was “just in case the cheque gets lost”. When asked how many times this had happened what do you think the answer was? Thats right, NONE!

A confirmation letter goes to another department in Leeds where it is sorted, batched, sorted, fine sorted, batched, queued and scanned and then sent to Newcastle. They then send this confirmation to West Kent who finally send it on to the customer.

End to End Times

The end to end time for this was an average of 71 days, its not hard to see why. Its also not hard to see where waste is. However the above processes had already been through BRP, mapped and documented by the bank, each part thinking that it was doing the best it could, with no one looking at the system as a whole. This process document had been presented to John at the outset, he had politely thanked them for it and “filed” it in favour of going out into the work with a senior leader to see for themselves.

Waste

John asked the audience for examples of waste that they could see in this design:

- Transportation

- Batching and sorting

- Scanning

- Letters

- Duplication

- Chasing

- Errors

- Cheque Centre

- IT

- Telephone

- Targets

- SLAs

- Lack of communication

Someone in the audience asked about redundancies once waste had been removed. John reported that removal of waste didn’t always result in staff being made redundant, it meant doing things in the right order and at the right time, with no duplication of effort. After an intervention an organisation will have additional capacity. Most organisations have more work then they can handle, having additional capacity to take up that work is a massive economic lever.

John also reported that doing a simple check of donor bank addresses they found that 60% of them were wrong, they had been sending letters to the wrong addresses! They also talked to the donor banks, not just to ask them if they had received their transfer request, but to start the conversation about what clean looked like to them. Seems like common sense huh? but how many of us work in organisations where if we delved deeper, and really look at what is going on, will see similar odd things and waste that seem the norm to those doing the work? I know I have in the past. John mentioned that this isn’t a one off either, many organisations he has worked with have similar horror stories.

Intervention – Principles of Re-Design

A few were mentioned:

- Design against demand

- Only do the value work

- Pass work on 100% clean

- Measures relating to purpose (in the hands of the worker)

- Understanding what matters to customers

- Use a batch size of 1

- Pull expertise

- Build knowledge in the front line

John mentioned the traditional process mapping technique used by Vanguard.

This differs from say value stream mapping. The method involves the following:

- Take a piece of paper and divide into 3 columns

- Start at the point of transaction with the customer demand and write down the activity that happens there

- Working back into the organisation write down all the activities that make up that process in sequence

- Ask type and frequency questions to establish demand and response, build these onto the map

- At each step of the activity, in the waste column, identify where waste exists and describe what it is, list the type and frequency of waste that occurs at each point

- In the final column identify at each point what impact the activity and/or waste is having on the customer

- As you map the process ask questions of the input/throughput/output

Note: the above is taken from Vanguards Process Mapping course and is copyright to Vanguard.

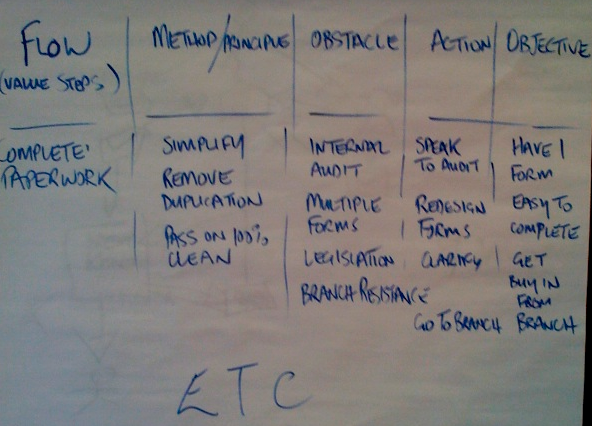

For this intervention they had used an alternative. This had resulted in an action plan that was presented back to senior leaders to approve. It took about a day to create.

Note that a value step is listed, in this case “complete paperwork”. By what method can we remove waste? 3 are listed. Obstacles for each are also listed (system conditions). Actions to remove these obstacles are listed (which became the action plan that senior leaders can help with). The objectives are listed.

Once approved by senior leaders Vanguard were given 3 months to roll in the redesign, this was because the bank wanted improvements made in time for the March and April spike.

Results

Redesign was completed in 3 months. The first customer to use the new service after redesign took just 12 days end to end, with a new average of just 9 days.

The redesign involved the following:

- 3 forms were reduced down to 1

- Removed the scanning, indexing and queueing

- Branch sends to donor bank directly if the customer brings the application form in

- If the customer wants to send the application form somewhere, as they can’t get to their branch, then they can send it to West Kent who then send directly to the donor bank

- Donor bank sends cheque back directly to West Kent

- West Kent send directly to the customer

- Modified the online system so that it was secure and applications didn’t need to be retyped or sent to the branch – yay IT

The following results have been achieved

Average End to End times – was 71 days now 9 days

% complete < 25 days was 0% now 98.3%

Funds received to customer account was 33 days now 1.9 days

% funds received to account

< 5 days was 0% now 93%

< 14 days was 29% now 100%

Having transferred an ISA last year myself, and waiting nearly 2 months for it to complete I can well believe all of this waste is not confined to the one bank that Vanguard worked with on this intervention. A fascinating case study and once again proof of improvement following usage of Vanguard’s methods.

Good examples